UBL Executes Pakistan’s Largest Ever PKR 75 Billion Interest Rate Swap with Jazz

United Bank Limited (UBL) has successfully executed a PKR 75 billion Interest Rate Swap (IRS) with Jazz, Pakistan’s leading digital operator, marking the largest interest rate swap ever concluded in the country.

The transaction enables Jazz to hedge interest rate risk on its long-term local currency debt, enhancing cash-flow predictability and strengthening its financial risk management framework. The deal further reinforces UBL’s pioneering role in developing Pakistan’s derivatives and hedging markets, setting new benchmarks for scale, structure, and execution.

UBL Acts as Sole Counterparty and Structuring Bank

UBL acted as the sole counterparty and structuring bank for the transaction, underscoring its expertise in delivering complex treasury and hedging solutions tailored to client needs.

The successful execution also reflects improved market stability and an enabling macroeconomic environment that supports large-scale financial transactions in Pakistan.

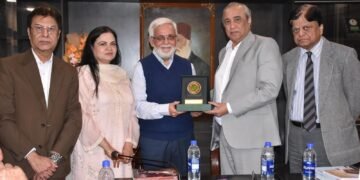

Signing Ceremony Held in Karachi

The signing ceremony for the landmark deal was held at a local hotel in Karachi. The Chief Guest on the occasion was Jameel Ahmad, Governor of the State Bank of Pakistan.

Prominent speakers included Mr. Muhammad Jawaid Iqbal, President & CEO of United Bank Limited, Mr. Aamir Ibrahim, CEO Jazz, Mr. Burak Ozer, Group Chief Financial Officer of VEON Ltd, and Mr. Muneer Kamal, CEO and General Secretary of the Pakistan Banks’ Association. The ceremony was attended by senior executives from the State Bank as well as leading industrialists and CEOs from Pakistan’s corporate sector.

IRS Deal to Boost Derivatives Market, Says UBL President

In his address, Mr. Muhammad Jawaid Iqbal, President & CEO of United Bank Limited, stated that the landmark interest rate swap transaction will pave the way for the development of the interest rate swap and derivative market in Pakistan.

He added that the deal signals UBL’s readiness to pursue more ambitious and high-impact opportunities in the future and expressed confidence that other banks will also step forward to undertake large derivative transactions.

Jazz Highlights Disciplined Financial Management

Mr. Aamir Ibrahim, CEO Jazz, said the transaction reflects the company’s disciplined approach to financial management and long-term value creation.

He noted that proactively managing interest rate exposure will strengthen cash-flow certainty while enabling continued investment in Pakistan’s digital infrastructure.

UBL’s Strong Market Position

UBL operates one of the largest banking networks in Pakistan, with over 2,000 branches serving more than 10 million customers nationwide.

The bank is also the first Pakistani bank to surpass PKR 1,000 billion in market capitalization, highlighting strong investor confidence in UBL’s fundamentals, strategy, and long-term growth outlook.