IMF and Pakistan Settle $7 Billion Credit Program

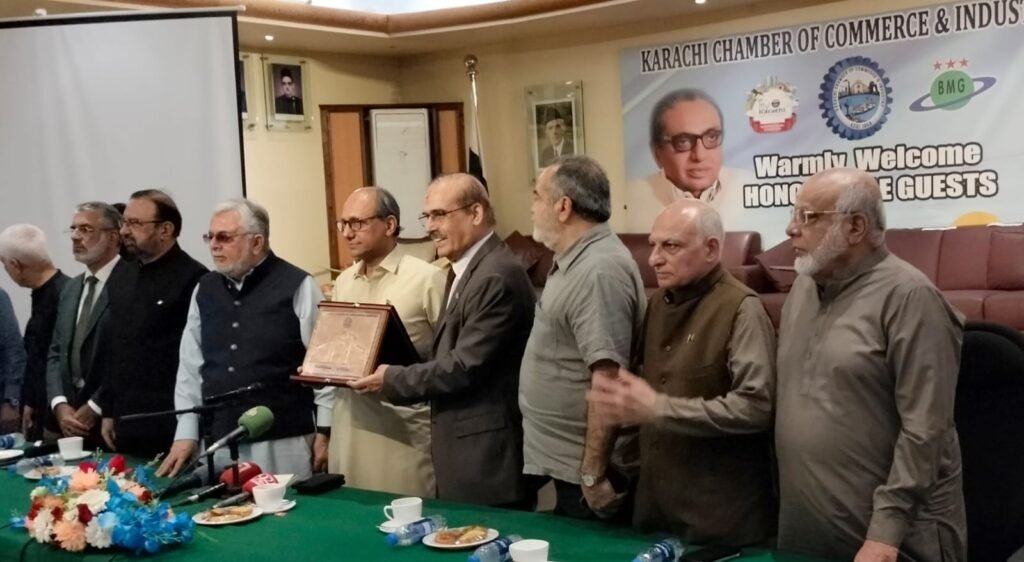

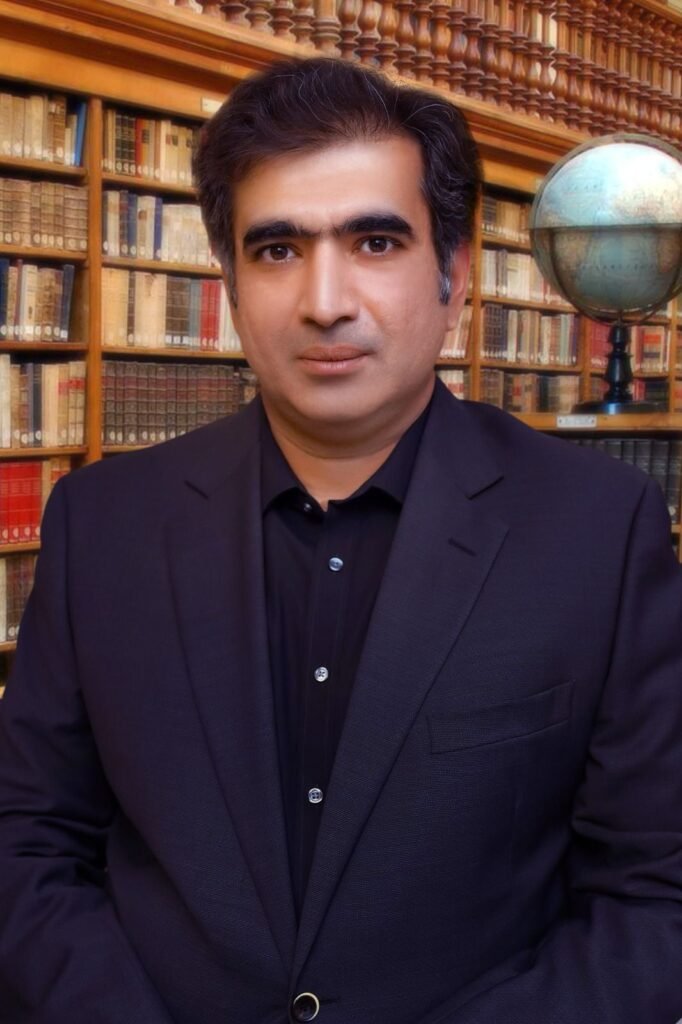

Syed Abid Hussain

On July 12, 2024, the International Money Fund (IMF) and Pakistan agreed for a $7 billion credit program set to most recent quite a long while. The essential objective of this Drawn out Asset Office program is to help Pakistan, a country that has confronted critical financial difficulties, in accomplishing strength and development that helps all residents.

Endorsement and Conditions

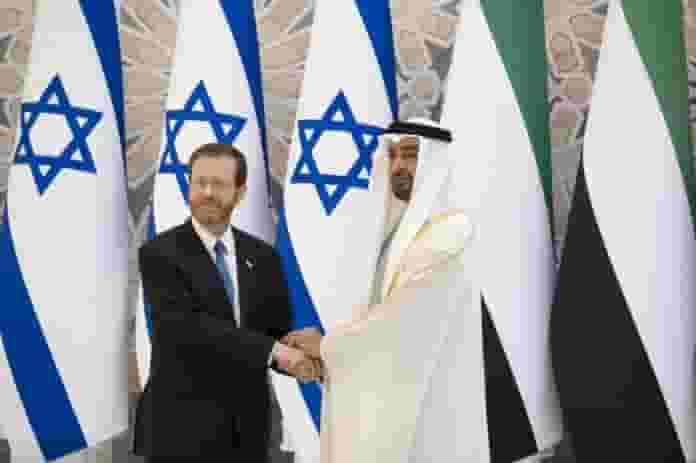

The IMF has expressed that the new program won’t begin until it is endorsed by its Chief Board. Moreover, Pakistan should get “ideal affirmation of key supporting confirmations” from significant turn of events and reciprocal accomplices, including China, the Assembled Middle Easterner Emirates, and Saudi Arabia. These confirmations might include credit rollovers or monetary commitments.

Foundation of Exchanges

The understanding follows conversations in May, soon after the fruitful determination of a $3 billion transient arrangement. This past arrangement was significant in balancing out Pakistan’s economy and forestalling a default on its obligation.

Monetary Changes and Goals

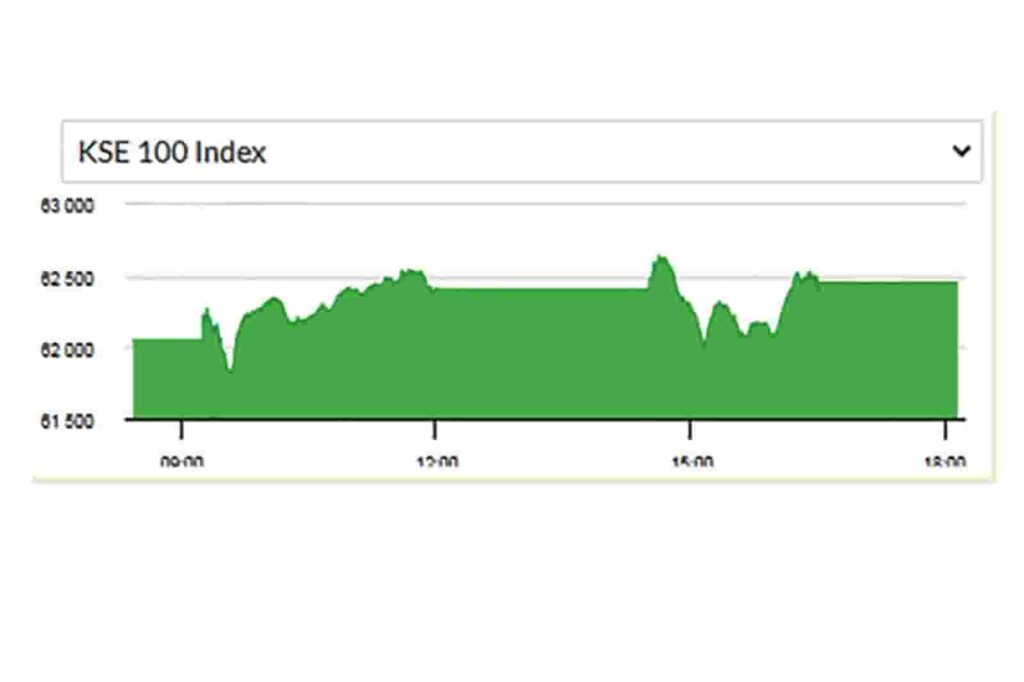

Nathan Watchman, top of the IMF mission in Pakistan, referenced that the new program plans to expand on the “hard-won macroeconomic steadiness” of the previous year. Endeavors will zero in on working on the wellbeing of the economy, diminishing expansion, building outer saves, and addressing monetary lacks to help private area drove development.

Monetary Targets and Financial Difficulties

To get ready for the IMF program, Pakistan has set an aggressive duty income focus of 13 trillion rupees ($47 billion) for the monetary year starting July 1, addressing an almost 40% expansion over the earlier year’s objective. Pakistan’s economy has confronted shakiness before, requiring 22 IMF bailouts starting around 1958. As of mid-July 2023, Pakistan stays the IMF’s fifth-biggest borrower, with $6.28 billion in exceptional credits.

This new drive shows the Pakistani government’s continuous endeavors, drove by Priest of State for Money, Income, and Influence, Ali Pervaiz Malik, to support monetary development and keep up with monetary steadiness. Malik has stressed the significance of finishing the new credit understanding before the IMF Leader Board’s yearly August break, however the specific timing of the Board’s thought stays unsure.